In simple terms, FMS is the use of mobile services instead of a fixed landline. FMS is potentially a massive threat to fixed operators; fixed phones can no longer compete with the types of services that mobile offers - besides the obvious advantage of mobility, mobile content and data services such as short message system (SMS) are making it increasingly difficult for fixed phones to sustain their market position.

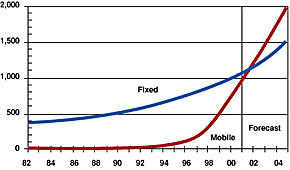

Diagram 1: Mobile and fixed telephone subscribers (in millions) worldwide, 1982-2005), Source: ITU World Telecommunications Development Report 2001

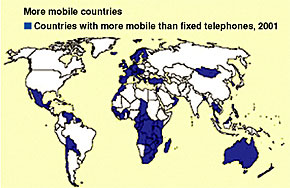

Since the mid-90s mobile services have been penetrating the expanding global telecommunication market and eroding the fixed line market share at an alarming rate. Diagram 1 reflects the expected growth pattern of mobile subscribers worldwide. In fact, this 2001 report forecast that beyond 2002, mobile subscribers would exceed fixed phones (2001 report). The high mobile adoption rate at the expense of the fixed is not necessarily a by-product of developed countries but rather is seen across many developing countries, as illustrated in Diagram 2. One explanation is that mobile networks are relatively faster and easier to install compared to fixed lines.

One would have expected that the US would be amongst the first to ride the FMS wave. It is reported that 14.4% of US consumers currently use wireless phones as their primary telco source, with the remaining 85.6% still using fixed lines. However, among those fixed line subscribers, 26.4% would consider replacing it with a wireless phone, demonstrating significant potential for mobile substitution over the coming years. (Commil, 2004).

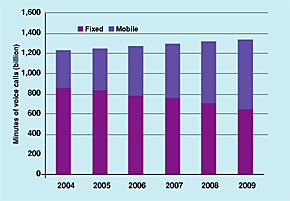

In Europe, it is estimated that up to 50% of all voice calls will be made over mobile phones by 2009 (Diagram 3); this is due to the emergence of 3G technology which aims at making voice calls cheaper and more reliable. According to an EU commissioned survey, many new users are going 'straight to mobile'. Indeed, it is estimated that approximately 12% of EU households are 'mobile only'. Many mobile operators are still focusing on increasing non-voice services to enhance their revenue, and voice services still account for over 80% of the average revenue per user (ARPU) in most markets. The cost and capability benefits of 3G will enable mobile operators to undertake an aggressive assault on fixed voice services and capture 50% of voice traffic by 2009 (Commil, 2004). It is worth mentioning that the boom in mobile phones is mainly due to growth additions of customer base rather than an increase in usage.

What Drives FMS?

Although one could argue that mobile phone networks are faster and easier to deploy compared to fixed, there are other factors that influence FMS.

For example, telecommunication regulation can widely influence the extent to which mobile operators penetrate local markets by setting price controls or having costly regulations with regards to geographic service coverage. Cultural factors can also increase or decrease the uptake of FMS. Depending on the preferred lifestyle, social and demographic structures, people will have strong opinions on whether fixed or mobile best suits their way of life. However, in general, empirical evidence suggests a tendency towards mobiles.

Market factors also influence FMS - by coupling the fact that subscribers are saving costs by disconnecting fixed lines, and mobile operators reducing service price premiums, price gaps are narrowing between fixed and mobile services; thus further accelerating the FMS drive in voice services.

Diagram 3: Forecast voice minutes from fixed and mobile calls in Western Europe, 2004-2009, Source: Sound Partners/Analysis Research, 2004

Mobile operators are also becoming more sophisticated with pricing plans; as they move from per minute billing toward bundled minutes and location-based billing. They are also hoping that the shift from prepay to contract packages will allow them to strengthen customer relations.

However, with the introduction of 3G, fixed phone operators will find it challenging to compete with the quality of capacity that could be attained by mobile operators. Amongst other innovative technologies that would boost FMS adoption is the increasing global uptake of PDAs - handhelds - that if coupled with broadband capabilities and VoIP (Voice over IP) technology would have a dramatic impact on fixed operators. Indeed, the emergence of wireless broadband has already caused a decline in the number of households with two fixed lines.

Corporations & FMS: Proactive

Thus far, the growing FMS trend has been illustrated from the single subscriber's point of view, mobile phone benefits could also be of significant benefit to corporates. In general, businesses appear unaware of the cost benefits associated with deploying mobile phones within their business.

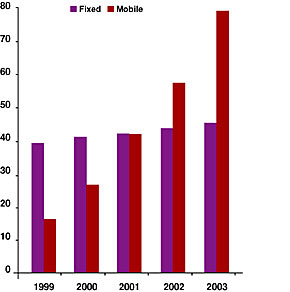

Diagram 4: Connections in Africa & Middle East (millions). Source: Pyramid Research, May 2004

The issue is that most enterprises when thinking about deploying mobile phones, base their strategies on the number of staff or individual job requirements, instead of taking a strategic view of total added value. The difference in the two perspectives when formulating communication strategies is that spin-off benefits emerge and can be built on as part of the company's strategic framework. For example, the maintenance cost of a fixed phone network might prove to be more expensive for the corporation compared to mobile phone applications on total lifecycle bases. Introducing mobile phones on a small scale might cause a duplication of communication costs, as is witnessed with many large corporations who have both fixed and mobile. Furthermore, mobile phones remain more convenient in terms of flexibility since they are not bound to physical locations. Hence, employees would tend to prefer to either call from or to a mobile phone. Fixed-to-fixed charges might be arguably cheaper but are significantly lower in volume - which when seen from an overall corporate perspective, would offset the potential benefit provided by their relatively lower cost per minute.

Oman's Experience of FMS Outbreak

When considering the FMS experience in an Africa, Middle-East (AME) context and compare it with the global trend, we notice a significant increase. Diagram 4 presents a comparison between fixed and mobile subscribers in the AME region between 1999 and 2003. Notably, fixed phones are almost constant compared to the substantial increase in mobile phones over the same period.

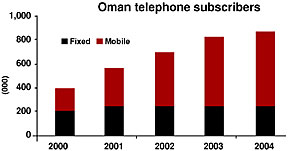

Diagram 5: Source: Hot-telecom, June 2004

Oman has an unique demographic and social structure as well as a relatively dispersed geographical spread and has shown a similar FMS pattern over the past few years (Diagram 5).

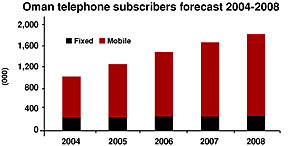

Despite this rapid growth, Oman has one of the least developed telecom markets in the Gulf with fixed and mobile penetration rates of 10% and 25% respectively (Source: Oman's Ministry of National Economy Publication, 2003). Having said that, Oman has tremendous potential for FMS acceleration, given that the country's mobile market is becoming more competitive which will yield benefits to both consumers and businesses, further generating FMS uptake. Current forecasts of future mobile penetration are promising, ensuring service capacity for the young and growing populating. (Diagram 6)

Is There Room for 'Fixed'?

As fixed versus mobile competition rages, actual migration will continue to increase if:

Diagram 6: Source: Hot-telecom, June 2004

» Price structures are competitive and users are willing to pay a premium for value added services, such as SMS, MMS, browsing and data content.

» Mobile operators chase voice traffic, as well as maximise coverage as they compete to provide value-for-money to consumers.

» Fixed operators will find it increasingly difficult to defend territory due to limited technological flexibility and the innovative content that mobile operators are able to provide, especially in terms of mobility, functionality and privacy.

» No other barriers emerge, such as quality and coverage associated with mobile phone applications.

Despite analysts predicting mobile phones would control 80% of total voice traffic, technology is adding mobility features to fixed phones and narrowing the functional gap. It is these improvements that will provide mobile operators with a real challenge. However, given the rapid pace of change in the mobile phone sector, fixed phone lines could shortly be a thing of the past!